Press Releases

Indorama Ventures agrees to buy Brazil-based Oxiteno to create a unique portfolio in high-value surfactants

16 August 2021

Bangkok, Thailand – 16 August 2021 – Indorama Ventures Public Company Limited (IVL), a global chemicals producer, today announced it agreed to acquire Brazil-based Oxiteno S.A. Indústria e Comércio, a subsidiary of Ultrapar Participações S.A. The acquisition gives IVL a unique portfolio in high-value surfactants and significantly extends its existing Integrated Oxides and Derivatives (IOD) business.

Oxiteno is a leading integrated surfactants producer, catering to highly attractive end-use markets in LATAM. The acquisition brings an excellent management team, world-class expertise in green chemistry innovation, strong customer relationships in Brazil, Uruguay and Mexico, and substantial growth potential in attractive end markets, including the U.S. through a new facility in Pasadena, Texas. Oxiteno has a strong commitment to environmental governance, and its focus on lowering greenhouse gas emissions will also enhance IVL’s ESG credentials.

Through the acquisition, IVL will assume a unique market position in technologies catering to niche, IP-rich and value-added applications in home & personal care, agrochemicals, coatings and oil & gas markets. The surfactants market has seen consistent growth over the last decade, driven by trends in population growth, urbanization and increasing hygiene awareness amid the Covid-19 pandemic.

With 11 manufacturing plants, customers in 4 continents, and an experienced management team, Oxiteno will complement IOD’s footprint in the U.S and Latin America, while its 5 research and technology centers will add to IVL’s innovation credentials in green chemistry. The extended footprint has potential to drive expansion in Europe and Asia by leveraging on IVOX’s surfactants business in Australia and India and IVL’s global presence in 34 countries. IVL expects to realize synergies of US$100 million by 2025 through portfolio adjustments, asset optimization and operational excellence.

IVL will purchase Oxiteno for US$1.3 billion (subject to adjustments at closing), with a deferred payment of $150 million in 2024. The transaction is subject to customary conditions to closing, including approval of relevant regulatory authorities. The transaction is expected to close in Q1 2022 and will be earnings accretive immediately. Financing is secured through deferred payment, using existing extra cash on our balance sheet, free cash flow generated from existing businesses, short term loans against working capital and the balance as long-term debt.

Oxiteno and Indorama Ventures both have family-business origins and share a similar mindset, which positions people as a key business differentiator and values innovation and investments in an increasingly diversified and efficient portfolio.

Mr Aloke Lohia, IVL Group CEO, said, “This acquisition is a natural fit for us. We have a solid track record of continuously driving value for shareholders through successfully integrating 50 acquisitions over the past 20 years. With Oxiteno, we are creating a global leader in surfactants. By bringing our companies together, we are strengthening our customer value proposition, our market reach, and our experienced team. Like us, Oxiteno grew as a family enterprise with an entrepreneurial mindset. The combination of our teams is unmatched in our industry, and we look forward welcoming them to our family.”

Frederico Curado, CEO of Ultra Group, said, “It is important to ensure that Oxiteno will benefit from integrating the new majority shareholder into the business, which is strategically positioned to lead the company through its growth path.”

Oxiteno’s HVA growth portfolio complements IVL’s existing IOD business

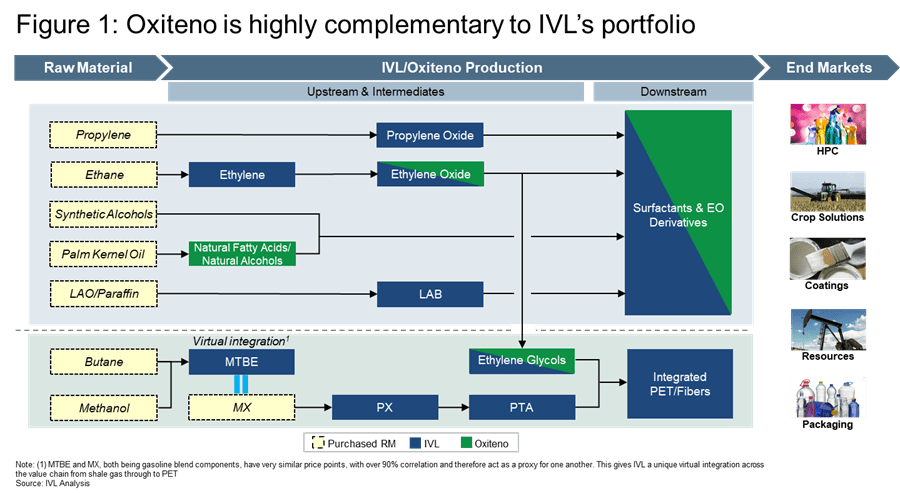

Oxiteno’s innovation-led HVA offering is a significant complement to IVL’s growth platform (Figure 1), and a key driver of IVL’s EBITDA projection over the next two years, which is 15% above the company’s forecast in January 2021. Together with IVL’s world-class assets, which were acquired from U.S.-based Huntsman in 2020 (Spindletop transaction), the acquisition of Oxiteno will lead IVL’s newest IOD business segment as a major high-margin growth driver alongside its traditional PET commodities business, creating a stronger and more resilient hybrid platform.

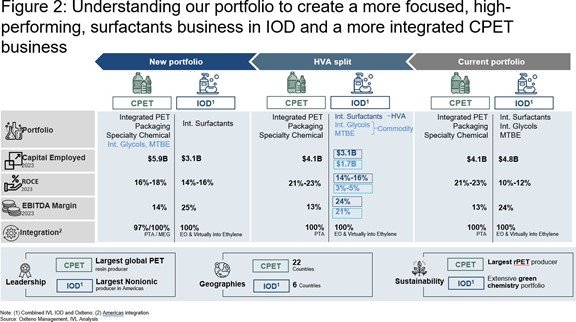

The linkages between IOD, Oxiteno’s high-performing surfactants, and the Combined PET businesses through their crude oil, shale and oleo feedstocks gives IVL integration benefits across the value chain, which is key to the company’s sustainable business model as the world’s largest producer of PET resin and a large geographic footprint in non-ionic surfactants in the Americas (Figure 2).

Oxiteno’s green chemistry innovation credentials also strengthen IVL’s ambitious sustainability objectives as a leader in PET circularity and bio-ingredients. Brazil is home to the largest inventory of ethanol, used to produce bio-ethylene to enhance EOD and PET sustainability. Today, IVL is the largest producer of resin used in recycled PET bottles and aims to recycle a minimum of 750,000 metric tons of PET globally by 2025, investing up to US$1.5 billion to achieve this goal.

Mr D K Agarwal, Chief Executive Officer of Combined PET, IOD and Fibers Business, said, “The combination of Oxiteno and IVL’s existing Integrated Oxides & Derivatives business is highly complementary. It gives us a presence in the high-growth Latin American markets, and we also become a more reliable supplier to our global customers, especially in Europe and the US. It will drive sustainable long-term value creation by accelerating our expansion in downstream chemicals, increasing our exposure to high-quality markets, and adding to our R&D and sustainability credentials. The portfolio will accelerate revenue and EBITDA growth, and deliver cost synergies.”

Driving enterprise growth through a proven strategy

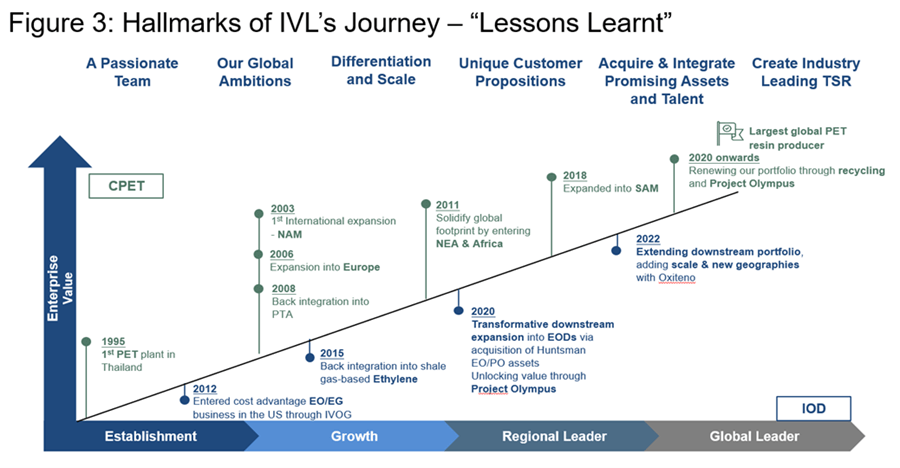

IVL has built a strong global platform based on some 50 successful acquisitions over 20 years, and is embarking on a program of continuous improvement through its 5 strategic priorities of costs transformation, asset optimization, adjacency growth, circularity, and organization excellence. These include significant investments in transformation, savings, and efficiency projects, which are driving expansion in IOD, strengthening its Fibers business segment, and enhancing value in its traditional Combined PET segment.

Mr Aloke Lohia, IVL Group CEO, added, “Since 2014 I have been very clear about our strategy of making big bets on HVA and innovation-led products that help us build global leadership positions. From our first PET plant in 1995, we have grown to our current global leadership position through a sound track record of acquiring and integrating new assets and teams that give us scale and differentiate us in the marketplace. This, and our focus on sustainable and circular models, our transformation and efficiency programs, and our ability to grow organically and from acquisitions, will continue to drive enterprise value.” (Figure 3)

IVL was advised by Deutsche Bank and Mattos Filho.

Back